What is a Folio Number?

What is a Folio Number?

Folio number is one of the most known words off late particularly after demonetization as the investments in equities and equity-related securities have increased manifold.

Mutual funds need some mechanism to store record pertaining to investments, transactions made by an investor. This information is also required to ensure each investor receives the money they are entitled to and also to determine the fees applicable to those investors. Given there is a huge number of investors who may/may not have similar names, it is technically impossible to use their name as a unique id; generally, a numeric unique id is allocated. Thus, folio number, similar to a bank account number, is a unique number provided to an investor at the time of investment. The asset management company (AMC) uses it to check the holdings in the name of the person to whom the folio is associated.

The unique number, though mandatory to be provided by every fund house, differs from fund house to fund house. New investors at the time of applying for investment in mutual funds typically key-in all their information which is sought by the fund house to open an account and once the account is open all the information presented in the form is mapped to a unique folio number which is then allotted to that individual. This unique number becomes the identifier for the investor.

Benefits of Folio Number

Following are the benefits of folio number:

- A folio number may be asked by the fund house from an investor to ensure the accuracy of the investor.

- Like a bank account number, the folio number can be used as a way to uniquely identify fund investors and keep records of items such as how much money each investor has placed with the fund, their transaction history, and contact details.

- The concept of folio number is very beneficial to the fund house as it helps them maintain a credible record system for every investor.

- An investor can make multiple purchases across asset class and funds using the same folio number within the same fund house. This saves an investor from having different folio for each fund he/she is invested in and also enables the investor to easily track his her portfolio on a regular basis.

Multiple Folios

Having multiple folios is more to do with the operational aspect of investing in mutual funds. There were some benefits of investing through multiple folios with the same fund house in the past – if you invest in a fund house with multiple folios and you have gained in one folio while a loss in other, individual had the flexibility of choosing which investment to sell first depending on their tax efficiency. However, if investments are in a single folio – first in/first out principle is used from taxation point. For equity investment, which is generally a long-term endeavor, it is, therefore, advisable to prune your folios. For administrative convenience, mutual funds provide with the facility of consolidating all folios in a master folio.

Where to Find Mutual Fund Folio Number?

Following are the ways by which you can retrieve your folio number:

Mutual Fund Statement:

When an individual purchases mutual fund scheme from the Asset Management Company or the fund house, the individuals receives a set of documents via Email and SMS. Folio number is found in a mutual fund statement that is very similar to your bank account statement. The mutual fund statement, received typically every month, summarizes your mutual fund investments. While the format of fund statement differs in layout across fund houses, the basic components of the fund statement remain the same.

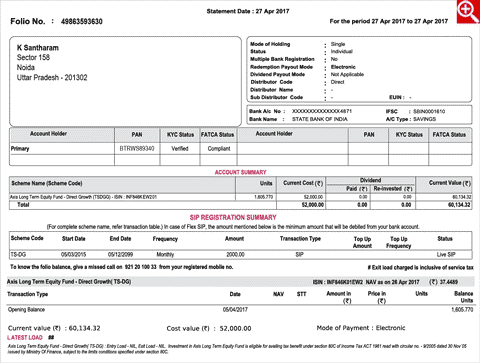

Mutual fund statement showing folio number

The above image tells you what a fund statement looks like. An individual should keep a record of his/her folio number, as it is the reference for the investment made. It is a good practice to ensure that the folio number is same when any additional investment is made in an AMC’s mutual fund scheme. If you do not use the same folio number, you will end up with many folios over time and it will make investments tracking cumbersome.

Consolidated Account Statements (CAS):

As the name suggests, consolidates account statement reflects money holding in a scheme. It reflects the scheme in which an investor is invested in, the amount invested, purchase price and the units allotted. Other information contained in CAS includes folio number, bank details, mailing, and contact details, nominee details, etc. The mutual fund industry issues CAS across fund houses on a monthly basis.

Other:

Folio number can also be found in the email and the SMS that are received from the asset management company or fund house.

What are the Advantages of Folio Number?

- It is the quickest and easiest way to check the track record of an investor

- It helps you to find out the transaction history and the contact information of an investor

- It allows you to trace money deposited in different mutual fund schemes

- It helps you to avail the investment statements for any period

- You can avail the list of allocation of units by the fund house with the help of folio number

- It helps you save time on re-doing KYC process while transacting with the same fund house

- It helps you to transact anytime anywhere and eliminates the hassle of noting and remembering the different account numbers

- Folio number helps in the verification of the account holder

No Comments