Orowealth Investment Idea – Hero Motocorp

Can Hero MotoCorp be a Hero?

Hero MotoCorp has lost ~36% from its 52-week high and ~43% from its lifetime high in August 2017. Does investing in Hero make sense? We examine this question below:

1) Is Hero MotoCorp a good company?

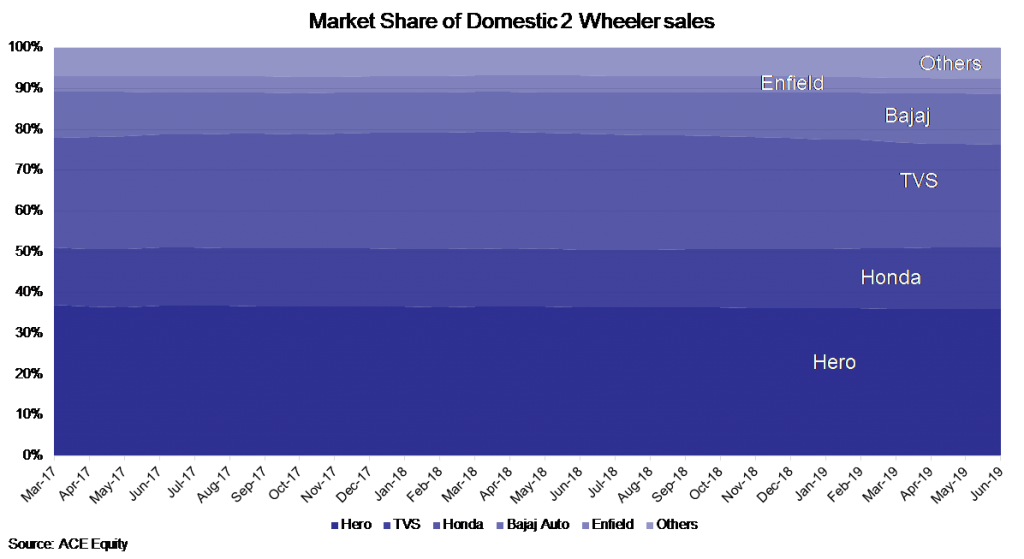

Hero MotoCorp is an established company with a long track record. Hero MotoCorp is the world’s largest two-wheeler manufacturer for 18 consecutive years. Hero MotoCorp Ltd. recorded its highest ever annual domestic sales of 7.61 million units during FY’19, which is 2 million units more than the nearest competitor. Hero MotoCorp has had a stable ~35% market share in the domestic 2-wheeler market over the last 3 years as shown in Chart 1 below.

Chart 1: Trailing 12-month domestic volume market share data

There are 5 major players in the industry with each having a large presence in a particular sub-segment. Hero had > 56% market share in the Domestic Entry segment, Deluxe 100cc Segment and the Deluxe 125cc Segment during FY’19.

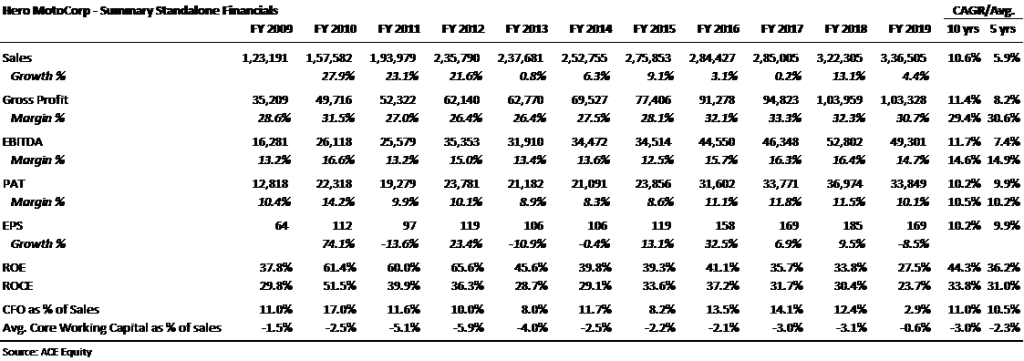

Hero MotoCorp has demonstrated strong profitability and cashflows with good growth. Hero MotoCorp had average ROEs of 44% over the last 10 years and 36% over the last 5 years, with Average Net Profit Margins of >10% during this period. The company has grown its sales by 10.6% over the last 10 years and 5.9% over the last 5 years. The company has not reported a decline in sales during this period. Its EPS has also grown at ~10% during the 5- and 10-year period. The growth in EPS has however not been as consistent as sales due to fluctuations in margins primarily due to volatile raw material costs. The company has very strong cashflows with the average cash flow from operations as a % of sales being >10%. It also enjoys very strong terms of trade as evident from its -ve working capital.

These number have been achieved inspite of various issues it has faced during the last 10 years such as intense competition, technology changes due to regulations, spells of relatively weak economic growth, raw material volatility, etc.

Chart 2: Summary Standalone Financials

FY’19 financials have been impacted primarily due to the slowdown in growth (discussed later in the note). The slowdown in growth has led to an increase in inventory and debtors leading to poor cashflow from operations. This has also impacted the ROE of the company. This is expected to reverse once growth resumes.

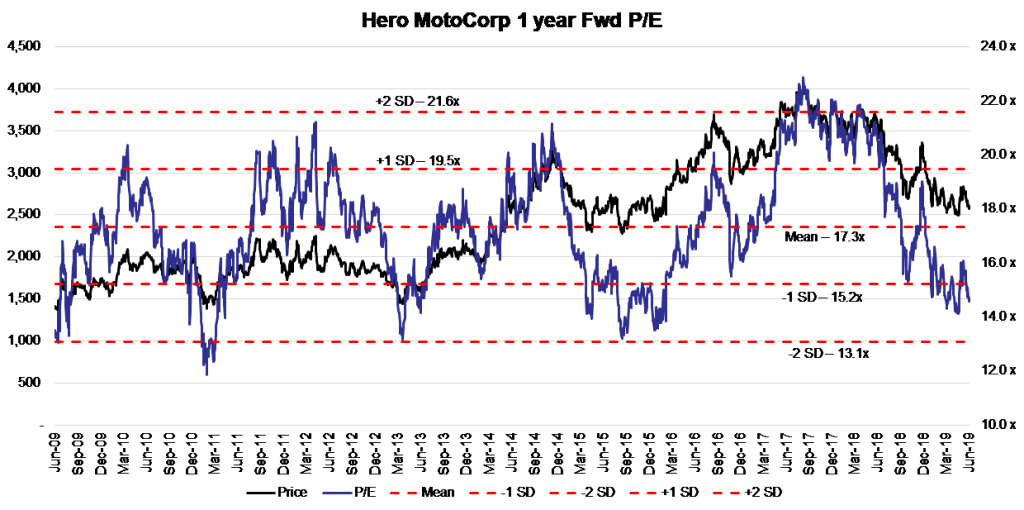

2) Is Hero an expensive stock to buy?

Hero has traded between 12-23x one year forward P/E during the last 10 years. It has consistently bounced back from a P/E of ~13.5-14x. At ~INR2,400, the stock is currently trading at a one year forward P/E of ~13.6x (based on consensus earnings estimates). The stock appears to be cheap as compared to its trading history during the last 10 years.

Chart 3: Hero MotoCorp 1 year Fwd P/E

3) Why could Hero MotoCorp have de-rated in past 12 months?

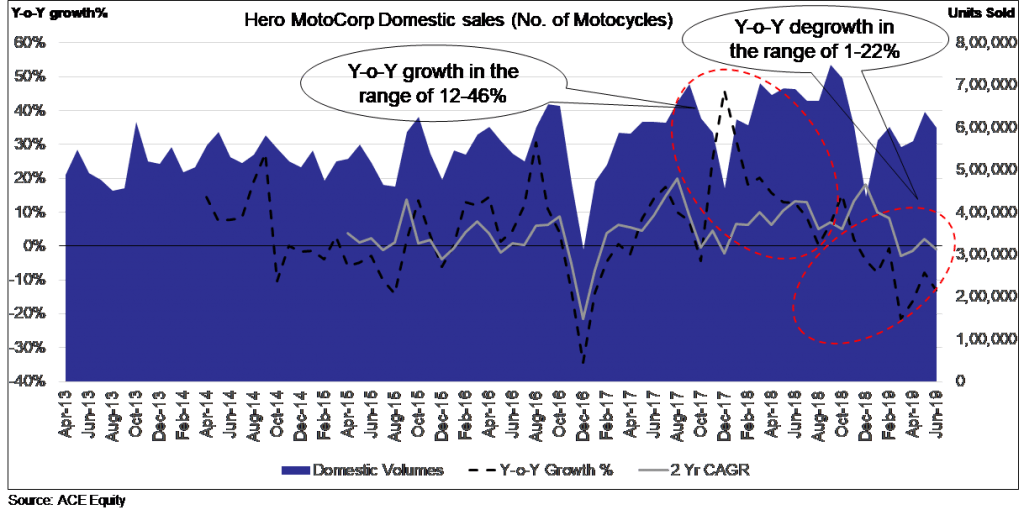

Growth Concerns: As evident from the chart of Hero MotoCorp’s monthly domestic sales volume during the last 6 years, 2-wheeler sales are highly volatile, which is typical of any product which whose consumption is discretionary in nature and dependent on multiple things such as higher income levels, availability of credit, interest rates, positive future outlook, etc.

Chart 4: Hero MotoCorp Domestic Sales Volume

Hero MotoCorp’s sales have fallen by as much as 22% on a y-o-y basis during the last 7 months since Dec’18. This has caused the market participants to question Hero MotoCorp’s growth going forward. We examine the possible causes for the poor growth below:

• Between Nov’17 and Jun’18, Hero MotoCorp’s volume grew in the range of 12-46% creating a high base. If you consider a 2- Yr CAGR, Hero’s sales have been reasonably stable in the range of +ve 18% to -ve 3% during the last 7 months. This fall in volumes is broadly in line with the industry’s fall in volume.

• India’s economy has grown slower than expected during the last 6 months, growing at 5.8% in Q4 FY’19, a 20-quarter low. This is sure to have an outsized impact on 2-wheeler sales.

• Due to the NBFC crisis in October’18, many NBFC’s stopped/slowed disbursements. This impacted retail sales.

• 2-wheeler dealers filled a lot of inventory ahead of the 2018 festive season, however due to the slowing economic growth and NBFC crisis, there was not adequate retail sales and the dealers were stuck with extra inventory. This additional inventory is currently being liquidated leading to poor sales.

Threat from Electric Vehicles: Market participants are also concerned by the entry of Electric 2-wheelers. Currently, electric 2-wheelers form a very small part of the of the domestic market 2-wheeler sales (estimated at ~1%). Consumers will need to gain comfort around the quality of the product, its reliability, product servicing, charging infrastructure, etc. before they decide to but electric bikes over models with the Internal Combustion Engines (“ICE”). It could take anywhere between 3-5 years for electric 2-wheelers to become mainstream products.

Even post electric vehicles becoming mainstream products, Hero MotoCorp is well placed to sell Electric 2-wheelers instead of the ICE. It has the distribution and brands required to sell and service 2-wheelers. It is already conducting R&D on new technology for electric vehicles. In case they are not successful in developing new technology, they have the balance sheet strength (>INR3,300 Crs of cash and no debt), to acquire this technology to launch electric 2-wheelers. (It has already invested INR330Crs in Ather Energy, an electric scooter manufacturer start-up).

4) What could change?

Over the next 1-2 years we see several positive factors which may not be factored by the market currently

• Interest rates in the economy are expected to reduce over the next 12 months leading to lower EMIs and making 2-wheeler purchases more affordable.

• It is expected that the reduction in interest rates and other measures taken by the government will improve the economic growth over the next few quarters.

• Credit markets have started recovering and this is expected to lead to better credit flow to strong NBFCs and end consumers.

• From April 2020, vehicle manufacturers will be able to only sell vehicles which are BS-VI compliant. The new vehicles are expected to be more expensive as compared to the current models. The consumers are expected to pre-pone their purchases to buy the cheaper version of the vehicles.

5) Can Hero MotoCorp give 20% returns from INR2,400 levels?

Perusal of Chart 3: Hero MotoCorp 1 year Fwd P/E shows it has traded at an average one year forward P/E of 17.3x. Assuming no growth in earnings, If Hero MotoCorp’s P/E recovers to its 10 year average during the next 12 months, one can make a 20%+ return (i.e. ~INR2,900 from INR2,400), with relatively low risk.

If held over the long term, a back of the envelope Dividend Discount Model suggests, this stock can give a 17-18% returns from these levels.

6) What are the risks?

The risk is there is no recovery in growth and multiples.

For any queries, please feel free to reach out to us on connect@orowealth.com

Disclaimer

Use of the information herein is at one’s own risk. This is not an offer to sell or solicitation to buy any securities and Orowealth will not be liable for any losses incurred or investment(s) made or decisions taken/or not taken based on the information provided herein. Information contained herein does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual investors. Before acting on any recommendation, investors should consider whether it is suitable for their particular circumstances and, if necessary, seek an independent professional advice. All content and information are provided on an “As is” basis by Orowealth. Information herein is believed to be reliable but Orowealth does not warrant its completeness or accuracy and expressly disclaims all warranties and conditions of any kind, whether express or implied. Past performance is not an indicator of future returns. Please use your discretion before investing. The Company, its clients, employees, associates or directors may have already invested in the stock. Kindly refer to the following link for further details https://stocks.orowealth.com/#/disclaimer

No Comments