Orowealth Investment Idea – Gruh Finance

Does Gruh – Bandhan merger provides any arbitrage opportunity?

Synopsis

We believe that at current market prices, there is still a merger arbitrage that is available for the investors of Gruh, translating into a pre-tax return of 10.8%. Also, it provides an opportunity to invest in a combined entity (Bandhan + Gruh), which can act a compound engine, delivering superior growth and a best in class ROE.

Background

On January 7, 2019, Board of Bandhan Bank Limited (Bandhan) and Gruh Finance Limited (Gruh) approved the merger of Gruh into Bandhan, subject to regulatory approvals. The share swap ratio accepted is 568 shares of Bandhan for every 1000 shares of Gruh.

Our back of the envelope calculation suggests that the current price provides an excellent opportunity for shareholders of Gruh, particularly after the share price corrected by ~20% post the announcement.

Below is our calculation which validates that the current prices still provides a significant merger arbitrage opportunity, for illustration purpose:

| Buy Gruh shares (No. of shares) | 1,000.00 |

| Price (as on 26 Aug 19) | 240.80 |

| Total Purchase cost | 240,800.00 |

| Share swap ratio | 568 shares of Bandhan Bank for every 1000 shares of Gruh Finance |

| Eligible shares of Bandhan bank as per swap deal (A) | 568.00 |

| Price of Bandhan Bank (as on 26 Aug 19) (B) | 469.65 |

| Cost of acquisition (paid for Gruh Finance) (C) | 240,800.00 |

| Value of Bandhan Bank shares (D = A*B) | 266,761.20 |

| Merger Arbitrage ((D-C)/C) | 10.8% |

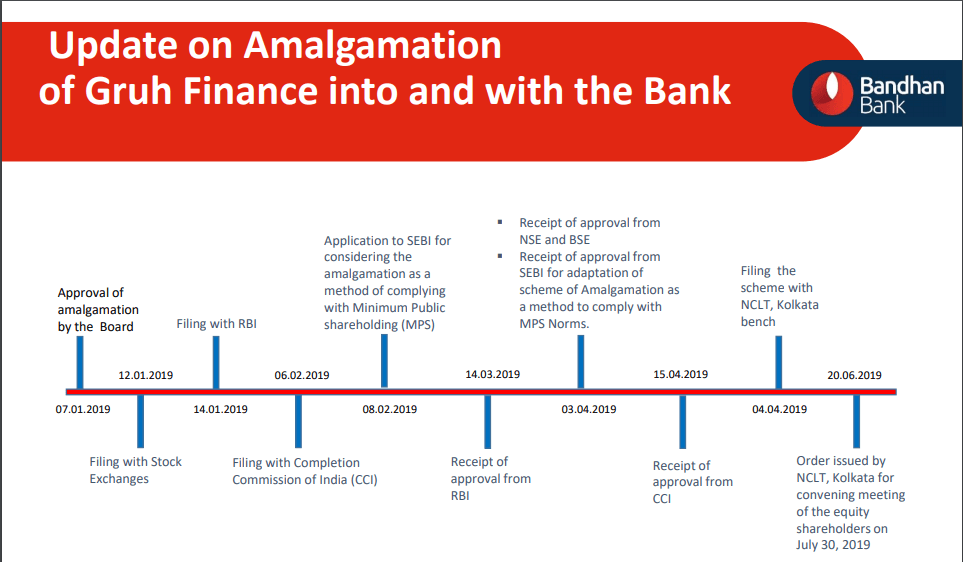

With the merger in the final leg of approval, we think that the merger process will begin shortly. Also, most of the key regulatory approvals are already in place, reducing the overall uncertainty regarding the merger.

Source: Company Investor Presentation – June 2019 results

Looking beyond the merger arbitrage….

Once the merger takes place, the investors in Gruh will ultimately become investors in Bandhan, which will be a combined entity consisting of Bandhan and Gruh. Both entities have a history of delivering strong operational performance on a consistent basis. Both entities cater to middle and low-income segment, thus providing greater synergies by providing complementary products to a similar customer base. While Bandhan has a strong vintage in Eastern and North-Eastern parts of India, Gruh has a strong presence in Western parts of India. While Bandhan did a commendable job at garnering adequate low-cost CASA within 2 years from getting a universal banking license, Gruh has kept its overall cost under control leading to the combined entity to enjoy the operational excellence witnessed by both.

We forecast that the loan growth will continue, as both the entities cater to underpenetrated segment and enjoy a market leader segment in their respective geography. Also, the combined entity provides an opportunity to invest in a high growth high ROE business, which will be sustained over a longer time period.

What are the risks?

The major risks involved are:

• The merger does not go through

• Post-merger implementation impacting growth

• Region-specific credit events affecting asset quality

• RBI diktat to bring promoter holding to 40% for Bandhan

For any queries, please feel free to reach out to us on connect@orowealth.com

No Comments