Ashiana Stock Note

Background:

• Ashiana Housing is a relatively small Real Estate company operating primarily out of Rajasthan, with a presence in other parts of India. The company’s project mainly includes comfort homes, senior living, care homes, and retail project. The company has a strong vintage of over 40 years and have established its niche among 5 states in India.

Why we like this company:

• This company is unique as compared to other real estate companies as it follows an execution based model instead of a land banking model. The company has a target land inventory of 5-7 times the current year’s execution plan.

• The company has In-house end-to-end construction capabilities to ensure higher control over cost and quality and flexibility in execution. The company also provides in-house facility management services and brokerage services for its clients. This ensures good maintenance of its properties and increases the saleability of its future projects.

• The management is viewed positively in the market.

• The company has a low debt to equity ratio.

• The stock is currently trading at a valuation of 1.4x P/B. The company has historically traded within a P/B range of 4.8x-0.3x.

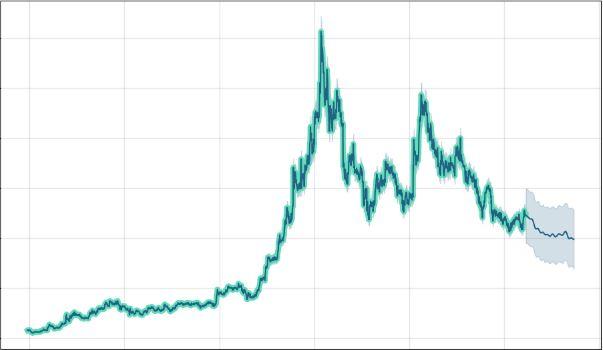

Share Price:

• The stock has a 52-week range of 155-101. During the last 10 years, the share price has hit a high of INR670.

Source: ACE Equity

Source: ACE Equity

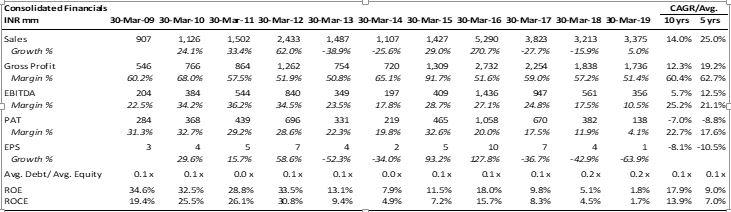

Financials:

• Ashiana follows a very conservative accounting policy of recognizing sales only on the delivery of projects. This makes the financials of the company very volatile and hence not truly representative of the true economic value of the company.

Source: ACE Equity

Risk:

• This is a high risk-reward play with the returns depend on the real estate cycle and a re-rating of the company.

No Comments