Budget 2019 – Key Highlights and Takeaway

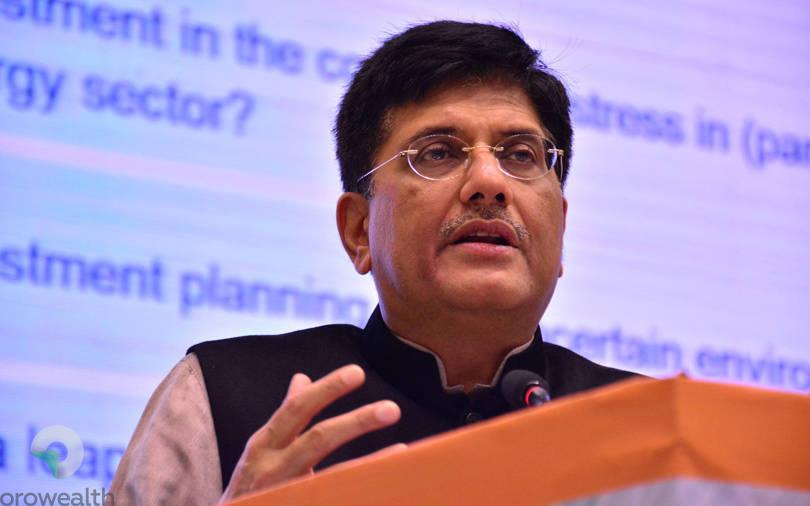

Interim finance minister Mr. Piyush Goyal presented the budget for the financial year 2019-2020. There were a lot of expectations from this particular budget as it would be the last fiscal budget presented by the NDA government before the general elections of 2019. Amid the backdrop of Rafale controversy and defeat in the three state elections, this budget also became a sort of ‘last play of the dice’ for the NDA government before the general elections.

At Oro, we keenly followed all the proceedings of this highly anticipated budget and have brought the key highlights and takeaways from the same.

Budget 2019 – Key Highlights and Takeaway

The Budget was mainly focused on the welfare of the middle class, farmers and socially backward classes.

1. There were some significant direct tax reforms announced such as a full tax rebate for a taxable income up to INR 5 lacs and other provisions like a higher TDS threshold for interest on saving products, a standard deduction up to INR 50,000, TDS exemption on notional rent etc.

Here is the table showing tax slab details and exemptions:

| As per Current Rules | As per Budget 2019 | As per Budget 2019 | ||

| Total Income | A | 1,025,000 | 1,025,000 | 1,050,000 |

| Deductions | ||||

| Standard Deductions | 40,000 | 50,000 | 50,000 | |

| Section 80C | 1,50,000 | 1,50,000 | 1,50,000 | |

| Section 80CCD (NPS) | 50,000 | 50,000 | 50,000 | |

| Section 80D (Mediclaim Self) | 25,000 | 25,000 | 25,000 | |

| Section 80D (Mediclaim Parents, Senior citizen) | 50,000 | 50,000 | 50,000 | |

| Section 24 (Housing Loan Interest) | 2,00,000 | 2,00,000 | 2,00,000 | |

| Total Deductions | B | 5,15,000 | 5,25,000 | 5,25,000 |

| Taxable Income | A-B | 5,10,000 | 5,00,000 | 5,25,000 |

| Tax as per Slab | C | 14,500 | 12,500 | 17,500 |

| Rebate | D | – | 12,500 | – |

| Tax Payable | C-D | 14,500 | – | 17,500 |

| Cess | 4% | – | 4% | |

| Final Tax Payable | 15,080 | – | 18,200 |

Note: You may be able to avail additional deductions pertaining to nontaxable perks, reimbursements, allowances, and HRA.

This is not to be construed as tax advice. Please consult your tax advisor for more details.

2. The budget also had some good news for the real estate sector. Tax exemption was extended on unsold inventory for 2 years, a GST council was formed to reduce the burden on home buyers, no tax on notional rent to be paid on a 2nd house and capital gains exemption extended to 2 house properties under section 54.

3. A big bang reform of this budget would be the PM Kisaan, to provide a guaranteed income of INR 6,000 p.a. to small farmers. The interest subvention of up to 5% will also provide a great boost to the agrarian economy, animal husbandry, and fisheries industries.

4. There is also a substantial increase of 35.6% and 28% in the budgetary allocation for the welfare of SCs and STs respectively.

The above measures would increase overall disposable income and should boost the consumption and investment story in India. We expect the increase in savings to get channelized into financial markets (via SIPs, small savings schemes etc. leading to an increase in financial products penetration) and a higher spend on consumer durables, FMCG, automobiles, farm equipment etc.

5. A major thrust was also seen on ease in compliance. Provisions like processing returns within 24 hours, unmanned & anonymous IT scrutiny, lower number of GST returns for small businesses etc. will be helpful.

6. Introduction of a Mega pension plan providing INR 3,000 per month for unorganized workers will bring a large population under the ambit of pension security with minimal contribution.

7. The Defence sector also received its highest ever allocation of Rs 3 lac crores

8. By projecting a fiscal deficit target of 3.4% for 2019-20, the Government took a bold move of accepting a slight deviation from the original target, mainly on account of the assured income allocation for farmers.

9. The interim budget also focused on the milestones this government has achieved over its 5-year regime along with laying down a vision for the next 10 years.

10. The size of the total budget for the coming year was Rs 27.84 lakh crores.

So overall it was a budget to benefit the masses (mainly 3 crores salaried, 10 crore workers and 12 crore small and marginal farmers) with an eye on the upcoming elections.

No Comments