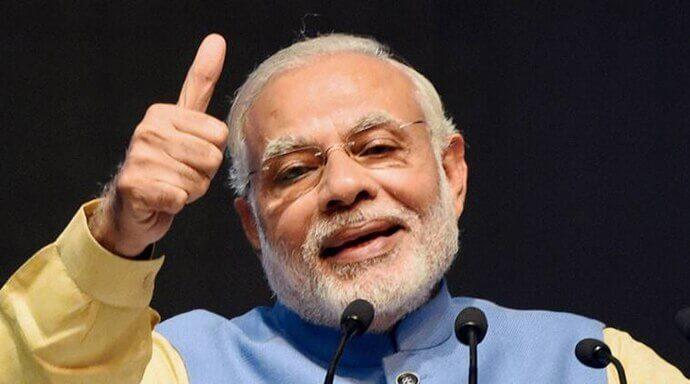

Modi 2.0 and Investment Outlook

As the dust settles on the latest Lok Sabha elections, with today’s results confirming the exit polls from a few days back, we should now look ahead and start planning for the next 5 years of our savings and investment portfolio.

Modi Government 2.0 returns with a historic mandate and a clean majority on top of a base of 5 years work. With the Rajya Sabha and the RBI also walking in sync with the government, there can be no better time nor a better opportunity than the next 5 years to truly transform India. Whether this will be done is anyone’s guess. Finger’s crossed with high hopes.

In the short term, there may be some good euphoria due to the strong mandate given to PM Modi and we can see 12,500 on the Nifty getting hit soon. We believe this rally should be used to reduce any excess equity exposure that you may have in your portfolio. Hence, don’t be very aggressive in buying at present levels. Stick to your existing financial plans and SIPs. You will get an opportunity to buy more aggressively sometime in the near future. Reality regarding poor company earnings, expensive valuations and other macro stresses can ensure a slide down by ~10% to 11,200 levels within the next 12 months. This fall would be an opportunity to again load up on equity before the market begins its next upward journey.

But don’t worry, such peaks and troughs are normal for a healthy market. The trend will continue to remain positive and in general, Indian stock markets will continue moving upwards to give you an average 12-14% p.a. growth.

If everything remains normal and the new government continues as it did in 1.0 (more on this later in the email), we can expect Nifty to hit 20,000 by the time this government’s tenure ends in 2024. That’s a good 70%+ returns from here !!

On the Debt front, you can expect 1-2 rate cuts over the next 12 months but not more. Expect debt market yields to remain around the current levels or head slightly lower. Given the current stress in debt and credit markets, you should stay only in high quality liquid or short term income funds for the foreseeable future.

It will be very interesting to watch who will be a part of the incoming cabinet and who will be the next Finance Minister. Will it remain Mr Arun Jaitley? or Will Piyush Goyal take over the mantle. But whoever the next FM is, he will have to address the aspirations of all the people who have voted for his government (and of those who haven’t). Expect just a few more goodies in the upcoming full budget in July/August as most of the benefits such as full tax rebate for a taxable income up to INR 5 lacs etc. were already announced earlier.

Based on PM Modi’s government 1.0, read on to understand what to expect in 2.0:

Very Likely Positives

1. Low and contained inflation. One of the best achievements from the first tenure was low and contained inflation. First time in decades inflation or ‘mehangai’ was not an election issue. The government has ensured come what may, inflation will be controlled and they have done it. Expect more of the same this time around as well with average inflation expected to be between 2-4% p.a.

2. Robust Foreign Inflows (FII & FDI): To continue in the same or in a better manner as compared to the past 5 years.

3. After a very long time, we will have a government with a good mandate in the Lok Sabha and in the Rajya Sabha simultaneously. Some policy paralysis of the past 5 years was due to a lesser presence in the Rajya Sabha. Expect some good, necessary and tough reforms (quite likely unpopular in the short term) to be passed.

4. Domestic Flows into financial markets to continue. Financialization of savings and movement of retail wealth into financial assets is a long term secular trend expected to continue for the next decade.

Expect Average Performance

1. Economic growth: India’s growth rate will be a mixed bag. It may not be too high but it will not be too low either. Expect GDP to average between 7-8% p.a. (in real terms) and 10-12% p.a in nominal terms. There is a slowdown visible in some parts of the economy but government spending should balance it out.

2. Fiscal Deficit to be managed just about ok: With major tax reforms done with in 1.0, and with the growth pangs hopefully over, we can expect 2.0 to reap the benefits of the hard steps taken earlier. Expect tax collections to be decent giving the government space to cut taxes (income and corporate) and increase spending.

3. Indian Rupee will remain under pressure with gradual depreciation. Expect Rupee to go towards Rs 80 over the next few years.

4. Some focus on Infrastructure and the manufacturing sector. Don’t expect too much given the track record. Some areas like smart cities, affordable housing, metros etc. will be the positives. Any chance of our GDP going close to 9-10% depends entirely on what the government does in this space.

Who knows, maybe a surgical strike on Infrastructure could be on the cards. We surely need it.

Keep Low Hopes

1. No relief for Current Account Deficit: With crude remaining high above $70 per barrel and Indian’s importing stuff like crazy, expect constant pressure on the Indian rupee. Export growth has been slow and it will remain poor for the foreseeable future.

2. Corporate Results: In general, company results have been disappointing over the past decade. We have seen some uptick in a few companies, however, there is no evidence to say that we will have a strong growth in earnings anytime soon.

3. Private Sector Investments: Unlikely to pick up significantly for the foreseeable future. Broad-based pick up is unlikely unless something dramatic changes on the policy or earnings front.

************************************************************************************

To summarize, we expect the government to perform decently well. India is on the right track and it is a good time to remain invested with a 5-year horizon.

As always, please feel free to reach out to your financial advisor in case of any questions.

If you don’t have one currently and are interested in getting a personal advisor to manage your portfolio, please drop an email to connect@orowealth.com

Jitendra kumar

Posted at 12:32h, 26 MayHi