Mutual Fund and the Stock market – Relationship Explained

“Mutual Fund investments are subject to market risk. Please read the offer document carefully before investing”

The disclaimer is well known by now and is found across media channels – be it print media or electronic media. Before we delve deeper into how market impact equity and debt fund let us see the importance of disclosure:

Why this disclaimer?

One of the objectives of the disclaimer is to comply with the statutory requirement whereby it is important to inform the investors that there are no guaranteed returns to their investment and some degree of risk is always associated with each fund.

What are market risks and how it impacts equity mutual fund?

Market risk is associated with factors such as a change in interest rate, fluctuation in currency, fluctuation in commodity prices (such as crude oil, precious metal, etc.), geopolitical risk, etc. These market events impact the performance of individual stocks and thus also impact the performance of mutual fund if these names are contained within that fund. For example, If the price of crude oil is increasing, then for companies that use crude oil as raw materials will see an impact on their operating profitability thereby resulting in subdued operating efficiency and thus the valuation.

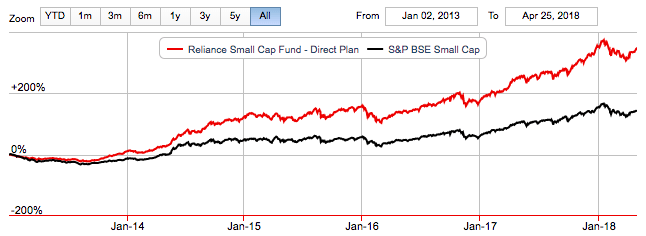

Similarly, when we talk about the stock market as a whole, the investor interest (measured by demand and supply) tends to determine the movement of the benchmark index. Thereafter, the stocks that have higher beta react with a higher magnitude. A mutual fund that is a basket of stocks thus performs depending on the performance of its underlying securities (refer to the chart below for Reliance Small Cap Fund and Market determined by S&P BSE Small Cap).

Source: Value Research Online

Are mutual fund investments subject to market risks alone?

The answer is no. Had it been the case that mutual funds only faced market risk then the performance of the similar type of schemes should be similar. However, this is not true. Within every category, the schemes from different or same fund houses differ in performance and risk profile. Thus, there is more than just market risk for mutual funds.

Fund manager and his approach matter – one of the key parameters that determine fund performance is the team of investment professional including the fund manager. It is the experience and capability of the fund manager to take right decisions that matter the most particularly at times when the overall market is volatile or gloomy. We believe real test of fund manager’s capability is to constrain losses when the market is in the bear phase. We believe a fund manager and his team plays a very critical role that involves stock selection to asset allocation and portfolio construction and diversification.

Having said it, we at Orowealth believe equity investors are well rewarded over the long-term when the investments go through a complete business cycle.

How market affects debt mutual fund?

These are the type of funds that generate returns by investing in fixed income instruments such as bonds. Fund houses invest in bonds that are traded similar to stocks.

First the basics, the prices of different bonds can rise or fall similar to stock prices. When the price of a bond rises, the fund tends to make additional money over and above interest income alone. This would then translate to higher returns for investors.

Change in bond price is primarily due to the change in interest rate and depending on the horizon of underlying securities, return contribution and strategy differ:

• Short-term debt instruments with a maturity of lesser than 4 years– These funds derive returns from the coupon (interest) payments from the instruments.

• Short-term debt instruments with a maturity of greater than 4 years– Returns are primarily derived from changes in bond prices with a share also coming from accruals of coupon.

Thus, returns in debt fund are sensitive to movement of bond price that is in turn dependent on the movement in monetary policy rates (interest rates at which the Reserve Bank of India (RBI) borrows/lends money to financial institutions such as banks).

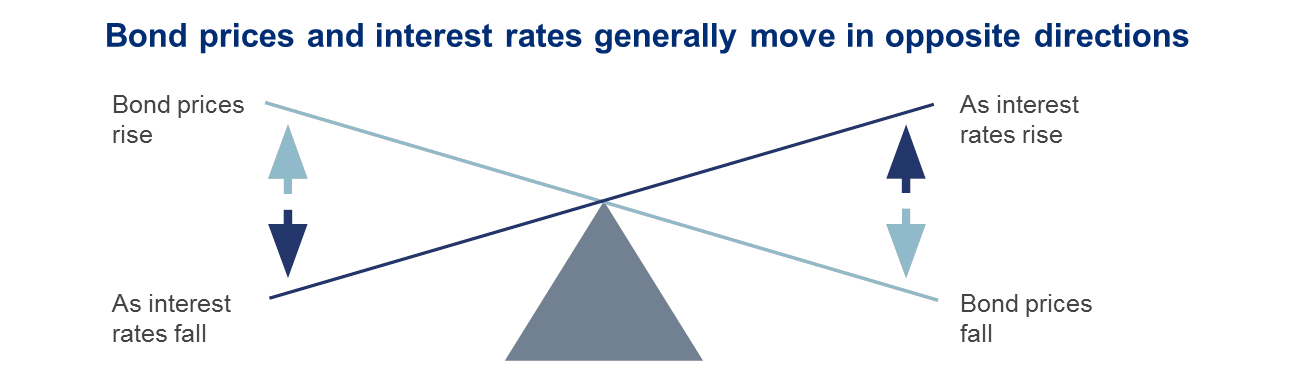

Pictorially, the impact of bond price and interest rate can be shown below:

Source: RBC Global Asset Management

Source: RBC Global Asset Management

Debt funds during the period of rising interest rate

Between 2014 and 2018, the RBI reduced repo rate multiple times that resulted in strong returns from debt funds. However, with the inflation rising amidst crude volatility and other parameters such as 7th pay commission, revised pay scale, monsoon and many more, the RBI is likely to increase interest rate now.

This will lead to volatility in the bond market and thus it would be wise to re-assess your portfolio particular allocation to the debt asset class. With India’s 10-year bond benchmark yield rising, the returns from long-term debt were impacted.

In an environment where there is uncertainty around rising interest rate, it is advisable to invest in debt fund with lower duration such as liquid funds or short-term debt funds as these funds are typically insulated from the bond price. We believe an investor should avoid using lump sum investment in debt funds unless the investment is made in a liquid fund or short-term debt fund.

Hope we answered a few of your questions! Reach out to us at Connect@orowealth.com in case of any queries. Would be happy to help.

G S Dhillon

Posted at 08:16h, 20 MayHOW would you recommend the investment of 3 lakhs, so that client is able to run 3 SIPs of 1000/- each automatically, for a definite time horizon of 5 years ?. what TAX free gain can be expected at the end of 5 years?

Jay Mehta

Posted at 13:03h, 28 SeptemberThis is an awesome article explaining the relationship between mutual funds and the stock market. Thanks for sharing the useful info.

Stock Cash Tips

Posted at 13:07h, 24 DecemberThanks for clearing doubt about stock market and mutual funds, I want to invest in mutual funds and after searching everywhere I find my solution here thanks again for sharing it!