SIP and Lump sum – A guide to better investments.

Of-late we have come across multiple queries from our readers on the benefits of Lump sum investment and Systematic Investment Plan (SIP) and which is better. While we believe that both SIP and Lump sum mode of investment offer their own pros and cons, we thought of educating our readers in greater detail with proper real-life examples regarding SIP and Lump Sum investment.

Read on!

SIP | Lump Sum | |

| What is it? |

|

|

| When is it beneficial? |

|

|

| Pros |

|

|

| Cons |

|

|

Example of both modes of investments

The following example clearly highlights the benefits of both SIP and Lump Sum investment. These examples clearly highlight who should opt for which investment mode.

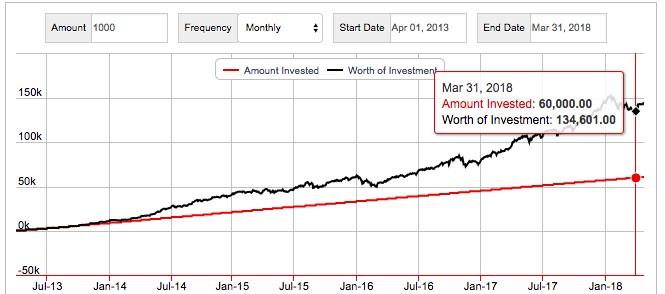

SIP Investment

SIP as highlighted above is suited for disciplined investment where an individual contributes a fixed amount on a monthly basis irrespective of the market movement. With small investments at regular intervals, an investor tends to get the benefit of rupee cost averaging and compounding.

Source: Value Research

Assuming an individual made an investment of Rs 60,000 over the period of five years starting April 1, 2013, with monthly contribution of Rs 1,000 in Reliance Small Cap Fund (direct) plan. This systematic investment plan grew to Rs 1,34,601 at the end of March 31, 2018, thereby generating systematic and sustained returns.

Lump Sum Investment

Lump Sum investment as highlighted above is more suited when there is a market sell-off due to a variety of reasons such as geopolitical tension, weak global cues, macroeconomic event, and the likes. We believe such periods where market witnessed a correction in excess of 10% should be used as a buying opportunity for investors looking to invest lump sump money. For example, on November 8, 2016 – the prime minister of India scrapped all high-denomination currency in a move to curb corruption. This resulted in a significant correction in the market and ever since demonetization effect stabilized, country’s trillion-dollar stock market has surged to become Asia’s second-best performer in 2017.

Source: Bloomberg

Assuming an individual made an investment of Rs 50,000 on November 15, 2018, in Reliance Small Cap Fund (direct) plan at a NAV of Rs 28.5; the individual would have generated over 67% returns on his investments when the NAV increased to Rs 47.7 and the corpus increased to Rs 83,685.

Things to consider before making Lump Sum investment or SIP investment

- Stay invested for long-term – Let’s assume you invested in the year 2008 when there was a substantial correction in the market. However, due to volatility, the investment would not turn to positive for a couple of years. But if you had remained invested until December 2017, the returns generated would have been healthy when compared to any other asset class. Thus, for both lump-sum investment and SIP investment, an investor should not be myopic.

- Articulate return and liquidity expectation – It is important that you get clarity on liquidity expectation and return expectation before investing. Should you need your investment within a year to repay any other liability or margin for any bigger investment in fixed asset, it is advisable you opt for debt fund or liquid funds as these funds are comparatively less risky and offer stable returns with a marginal premium over returns generated from traditional investment instruments such as fixed deposits. If you invest in a lump sum or by SIP in equity dominated funds, it is suggested to give it at least three years to show outperformance.

- Patience is the key – Most important principle in equity funds is to maintain your calm and equanimity. For example, an investor who invested in thematic funds such as technology fund in 2002 saw a significant decline in NAV to the tune of 3/4th. This was the time when both SIP investor and Lump Sum investor topped up their investment given the fundamental story was intact from a long-term perspective. Over time these funds became multi-baggers much time over. Thus, despite the inherited risk, an investor needs to be calm and patient.

We think we have cleared some of the major doubts about SIP and Lump sum investments you might have had. Do let us know if you need any help. Drop us a line at connect@orowealth.com and we would be happy to help!

Until then, happy investing! 🙂

No Comments